30-Member Preferred Return Fund Tracking Spreadsheet (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INVESTMENT VEHICLES EXCEL DESCRIPTION

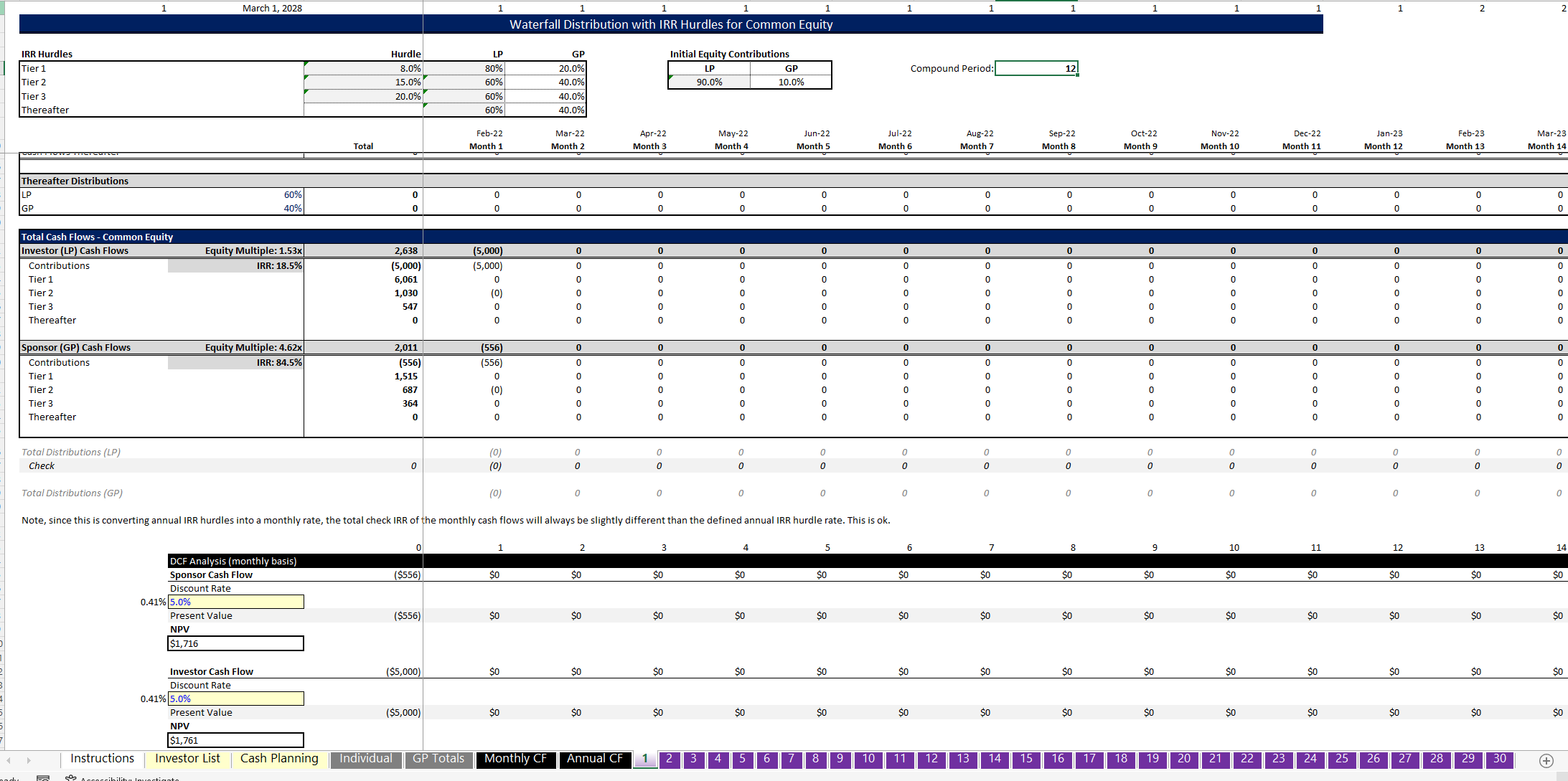

Joint venture cash flow waterfalls are one of the trickiest things that I see clients needing help with. There is a big difference in being a good operator and fully understanding the math and logic in regards to how a preferred return is calculated with multiple hurdles.

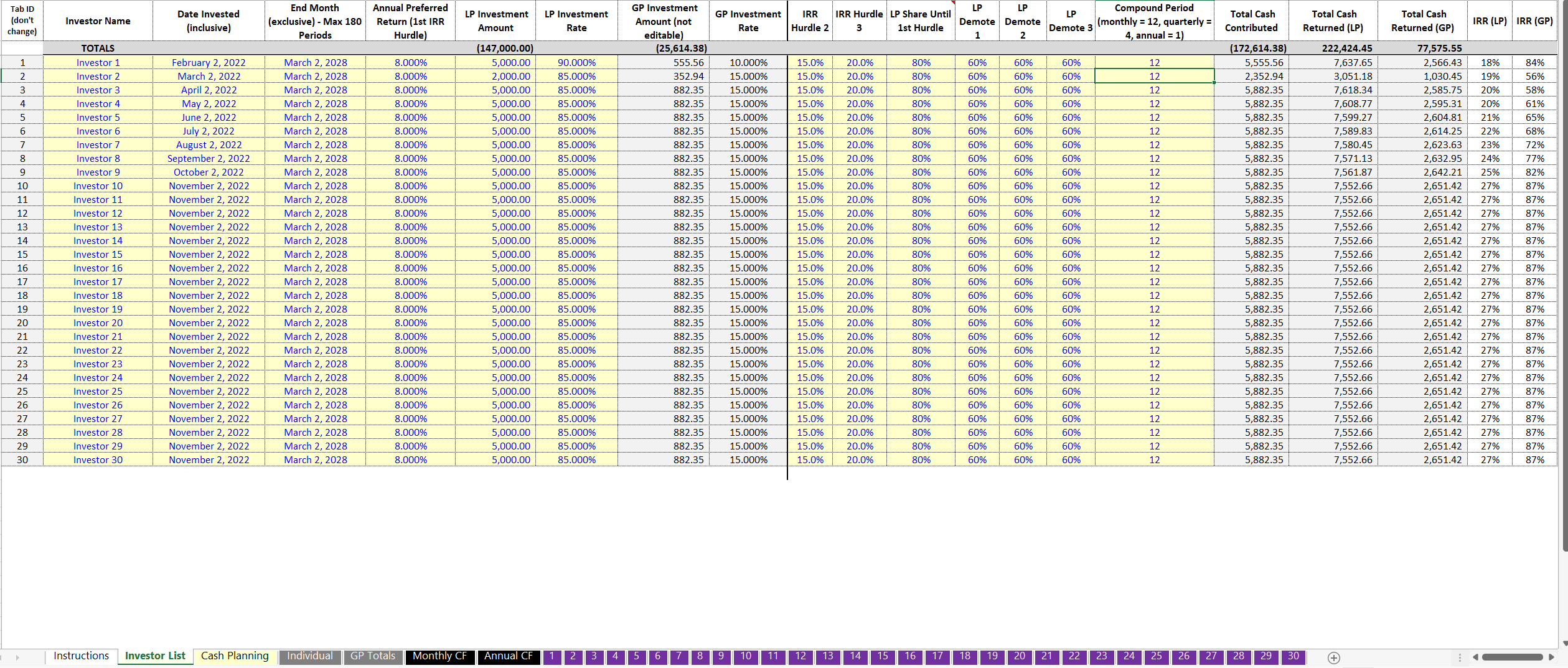

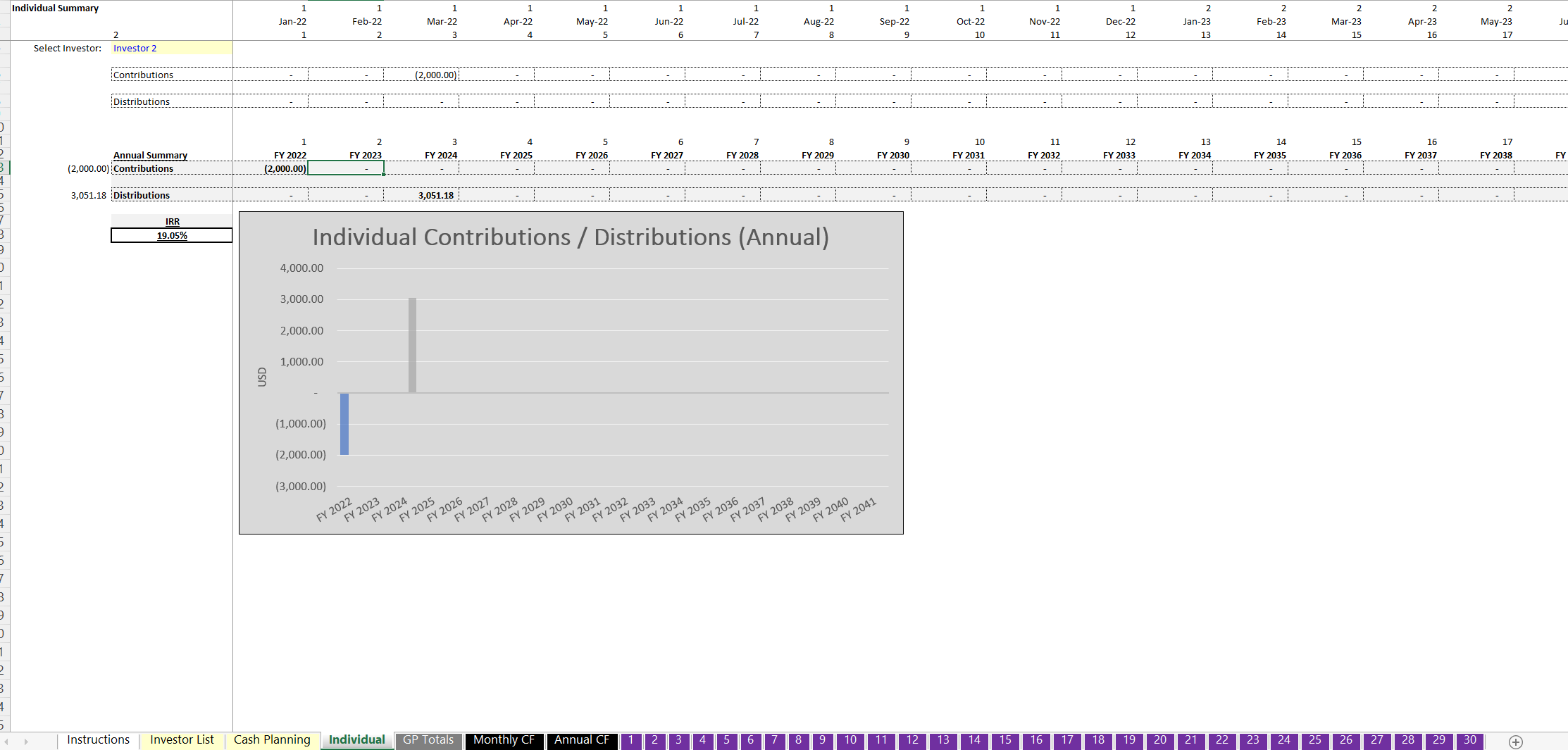

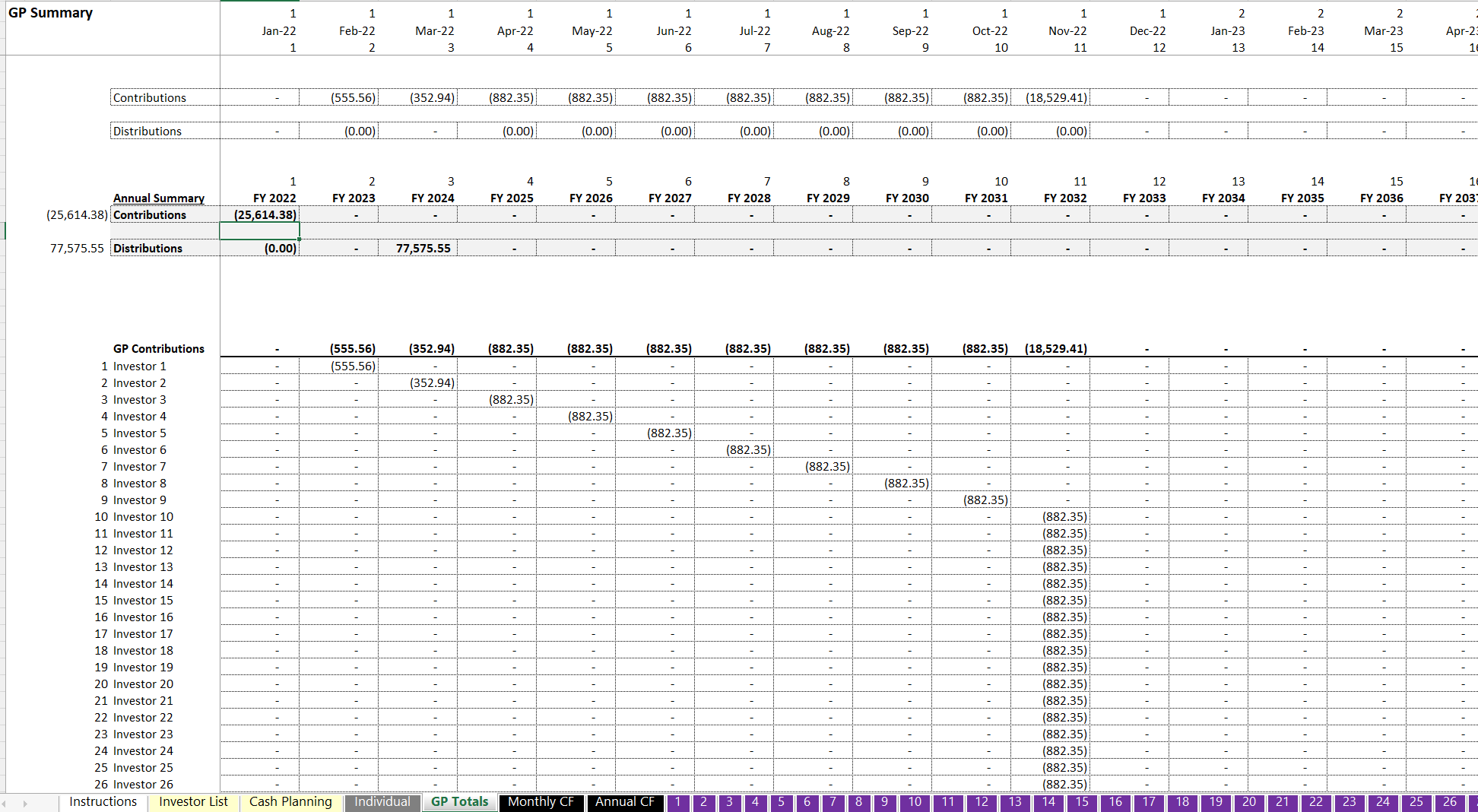

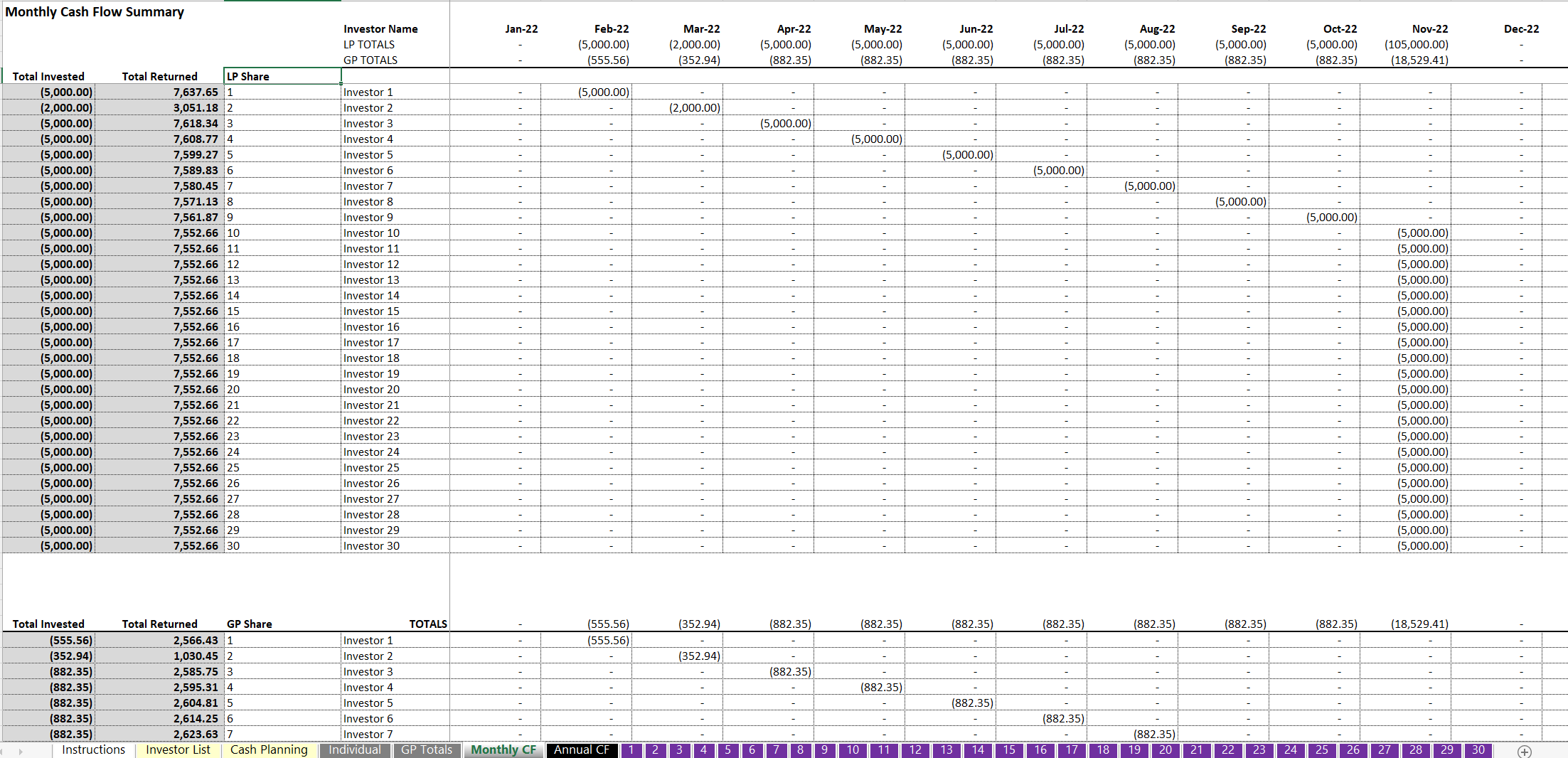

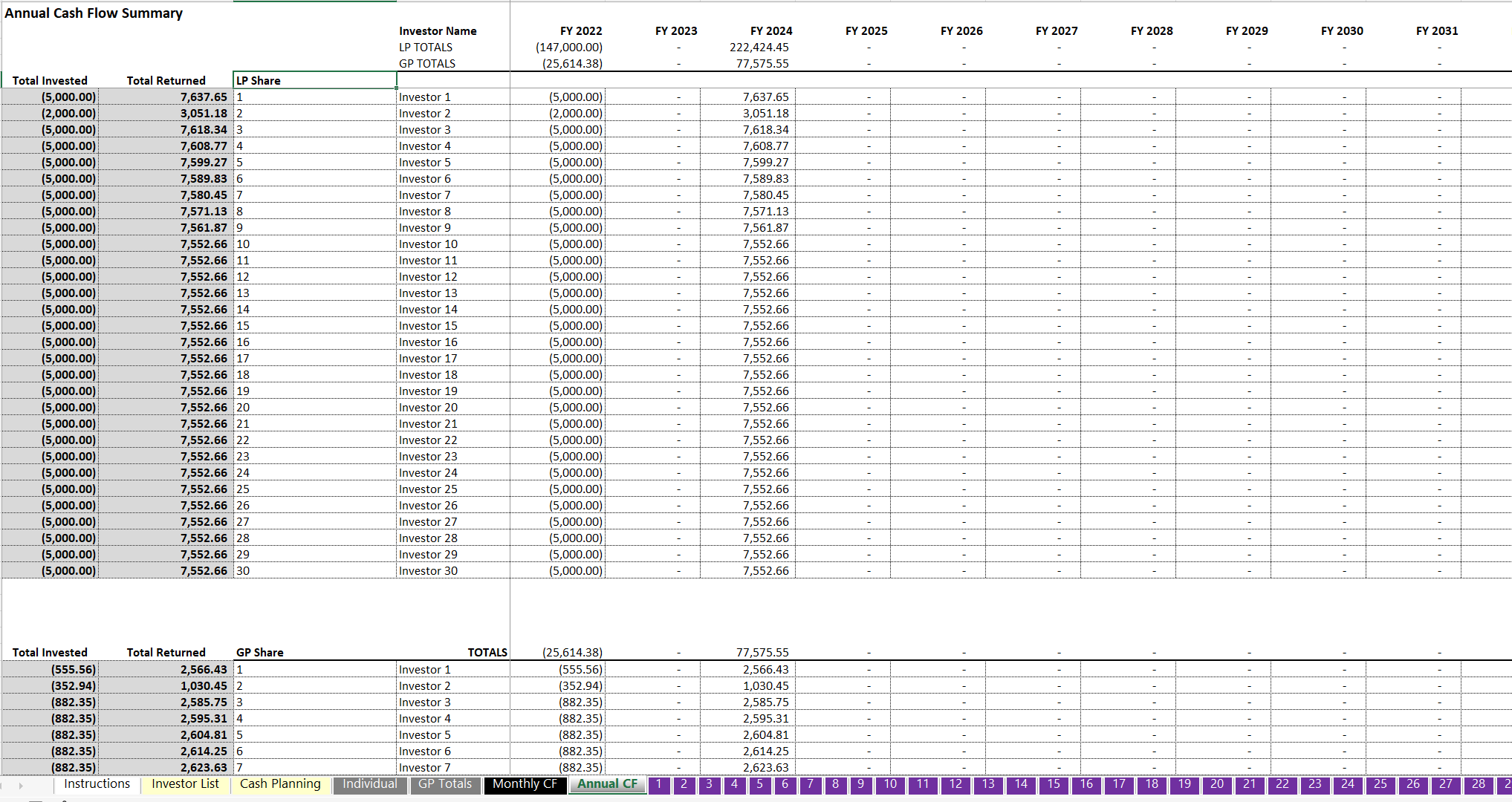

This is a very helpful template to help track the preferred return of up to 30 investors in a fund for up to 20 years of time.

The user can define the preferred rate of return individually for each investor as well as their 'deposit date' and 'end date'. Any distributions made within that time frame will go to investors based on their accrued return due.

The easiest use case / structure of this tracker would be to define a cash split rate between the LP/GP up to the LP achieving a defined pref. rate. Then, a second split rate can be defined for any remaining cash flows.

The initial split rate can be hard preferred equity (100%/0%) and then 0%/100% thereafter or maybe the LP gets a share of upside after their initial hurdle is satisfied. You can structure all sorts of operating agreements around the logic in this joint venture template.

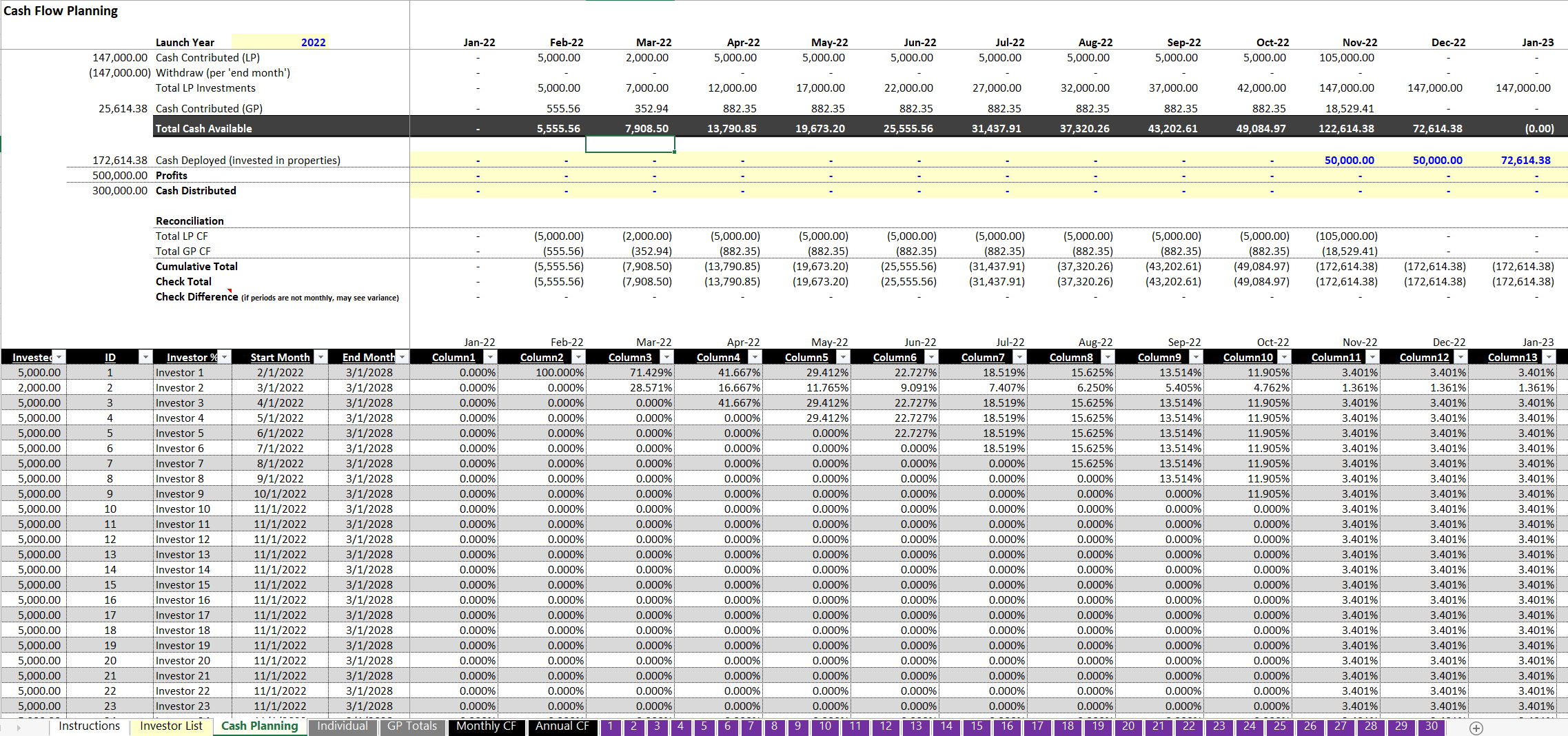

Note, the template is not just for tracking historical actuals but can also be used to forecast expected returns based on defined distributions over time and expected start/end dates of various investors.

For the fund operator, I made a cash flow planning tab where the month-end cash position is equal to total deposits less cash deployed plus profits less distributions. The profits and distributions can be manually defined each month.

There is no fee built into this model. That means the GP earns income based on their share of any distributions only (and those will be subject to the cash flow waterfall / preferred rate hurdles for each investor). Also, the GP will have an option to contribute funds if so desired.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Investment Vehicles, Return on Investment Excel: 30-Member Preferred Return Fund Tracking Spreadsheet Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping